存最新的白皮书 Advancing Together: Leading the Industry to Accelerated 结算 outlines a two-year industry roadmap for shortening the settlement cycle for U.S. equities to one business day after the trade is executed (T+1).

麦克麦克莱恩, 存 Managing Director and General Manager of Equity 清算 and 直接转矩 结算 服务, discusses the findings in the paper and the next steps necessary to galvanize support and lead the industry to an accelerated settlement cycle.

Q: What are the industry benefits of accelerated settlement?

A: 结算时间等于交易对手风险, 保证金要求, 哪些是为了减轻这些风险而设计的, 代表成员的成本. The immediate benefits of moving to a T+1 settlement cycle could mean cost savings, 降低市场风险和降低利润要求.

如今,平均价格超过13美元.4 billion is held in margin every day to manage counterparty default risk in the system. Shortening the settlement cycle would help strike a balance between risk-based margining and reducing procyclical impacts.

这篇论文的一个重要发现是, our risk model simulations have shown that the Volatility component of NSCC’s margin could potentially be reduced by 41% by moving to T+1, assuming current processing and without any other changes in client or market behavior.

Q: What is multilateral netting and why is it so beneficial?

A: One of NSCC’s primary roles in the industry is netting — the automatic process of offsetting a firm’s buy orders for a particular security against its sell orders for that security. Netting consolidates the amounts due from and owed to a firm across all the different securities it has traded to a single net debit or a net credit.

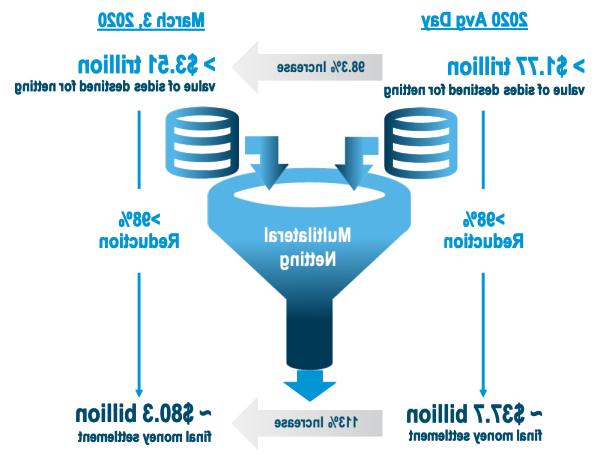

Allowing trades to “net” settle reduces the total amount of cash and securities that have to go back and forth throughout the day, and eliminates a significant amount of operational and market risk. By netting down or reducing the total number of customer trading obligations that require the exchange of money for settlement, NSCC helps to minimize risk and free up trillions of dollars of capital each year. 每一天, NSCC netting reduces the value of payments that need to be exchanged by an average of 98-99%.

问:为什么停在T+1或T+1 / 2? 为什么不去实时结算呢?

A: Real-time settlement is a simple technical solution but a very complicated market structure change. While the industry should continue to aspire to real-time, it is more pragmatic to reduce the settlement cycle in stages to capture the benefits faster. With real-time settlement in today’s market structure, 整个行业——客户, 经纪人, investors – loses the liquidity and risk-mitigating benefit of netting, and that is particularly critical during times of heightened volatility and volume. For example, on a typical trading day, NSCC processes an average of about $1.7万亿的股票交易. The multilateral netting process reduces that number by about 98%, and the total value settled is around $38 billion. Netting allows brokerages to transfer that $38 billion between parties only once at the end of the day. 在实时结算场景中, netting is not possible and trillions of dollars in cash and securities must move through the financial system on a continual basis throughout the trading day. This creates massive market and capital inefficiencies, 增加了信贷和经营风险, 并增加了贸易各方之间的成本, 可能会破坏市场的稳定.

Accelerating settlement requires careful consideration, 行业协调, and a balanced approach so settlement can be achieved as close to the trade as possible (for example, T+1或T+1 / 2), without creating capital inefficiencies and introducing new, 意外的市场风险, such as eliminating the enormous benefits and cost savings of multilateral netting.

Q: What needs to be accomplished to accelerate the industry’s settlement cycle to T+1 and beyond?

A: 存 is prepared to move quickly to lead the industry to accelerate the settlement cycle to T+1 and beyond. NSCC and 直接转矩 already support T+1 and even some same-day settlement using existing technology, though many market participants do not use this option due to market structure complexities, 遗留业务和操作流程. 许多人没有意识到, 直接转矩 has always been a T+0 settlement platform ever since its inception in 1973 -- even when the industry settled at T+5, T+3,现在是T+2.

正如我们在论文中所描述的, 在我们与业界的讨论中, many firms appear ready to start revising their processes to accelerate settlement. They realize it’s in their best interest: shortened settlement times reduce market risk 保证金要求, which would allow firms to use those resources in other ways.

Equity clearing and settlement is part of a much larger ecosystem of linked financial markets. Accelerating the settlement cycle would have upstream and downstream impacts on other parts of the market structure, 包括衍生品, 证券借贷, 现金借款, 外汇及担保品处理, and developing a new accelerated settlement system could fundamentally change current market structure. 为了移动到T+1, industry participants must align and implement the necessary operational and business changes, 监管机构必须参与进来.